QuadrigaCX: The Impact on Public Perception of Cryptocurrency as an Asset Class

QuadrigaCX: The Impact on Public Perception of Cryptocurrency as an Asset Class

Introduction

Cryptocurrency has been gaining traction as an alternative investment option over the past decade. However, incidents like the QuadrigaCX debacle have raised concerns and impacted public perception of cryptocurrency as an asset class. Let’s delve deeper into the issue and understand the implications it has on the wider crypto landscape.

What is QuadrigaCX?

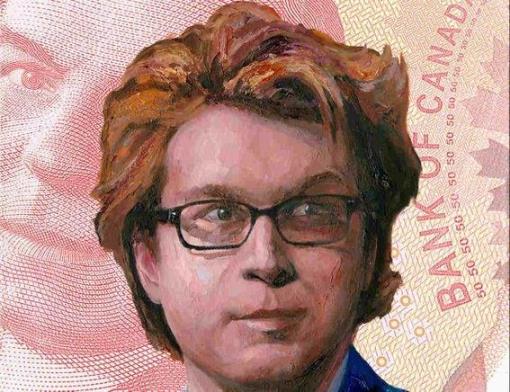

QuadrigaCX was once one of Canada’s largest cryptocurrency exchanges, allowing users to buy, sell, and trade various cryptocurrencies. In January 2019, the shocking news broke that the company’s founder and CEO, Gerald Cotten, had passed away, taking with him the private keys to access customers’ digital wallets. The incident left approximately 115,000 customers unable to access their funds, totaling over $190 million.

The Impact on Public Trust

The QuadrigaCX incident sent shockwaves throughout the cryptocurrency community and beyond. It highlighted several issues that have negatively impacted public perception of cryptocurrency as an asset class.

1. Security Concerns

One of the major concerns highlighted by the QuadrigaCX incident is the security of cryptocurrency exchanges. Users entrust their funds to these platforms, and incidents like these raise questions about the reliability and safety of such services. Investors are now more cautious and hesitant to invest their hard-earned money in crypto exchanges.

2. Lack of Regulation

Cryptocurrencies operate in a relatively unregulated market. While some argue that this freedom is one of the strengths of crypto, incidents like the QuadrigaCX case demonstrate the drawbacks of minimal oversight. The lack of regulation allows for potential scams or fraudulent activities, leaving investors vulnerable.

3. Transparency Concerns

QuadrigaCX also shed light on the lack of transparency within the cryptocurrency ecosystem. The company’s failure to provide proper audits and financial statements raised suspicions among users and further eroded public trust. Potential investors now consider transparency and credibility as vital factors before getting involved in cryptocurrency investments.

FAQs

Q1: Is cryptocurrency safe to invest in?

A1: While incidents like QuadrigaCX have raised concerns, it’s important to remember that not all cryptocurrency investments are risky. Stick to reputable exchanges, use hardware wallets to store your assets securely, and do thorough research before investing.

Q2: Are cryptocurrency exchanges regulated?

A2: The level of regulation varies from one country to another. Some jurisdictions have implemented regulations to protect consumers and maintain market integrity, while others have limited oversight. It’s crucial to choose exchanges operating in regulated jurisdictions.

Q3: How can I ensure the security of my cryptocurrency investments?

A3: When investing in cryptocurrency, follow best security practices such as using hardware wallets, enabling multi-factor authentication, and regularly updating your software. Be cautious of phishing attempts, and conduct thorough research on exchanges before using their services.

Conclusion

The QuadrigaCX incident had a significant impact on public perception of cryptocurrency as an asset class. It highlighted security concerns, the lack of regulation, and transparency issues within the industry. However, it is important to note that not all cryptocurrency investments are risky, and by following best practices and investing wisely, individuals can mitigate potential risks and participate in the cryptocurrency market safely.